Estate Planning Attorney Near Me 10007: A Local Guide

Why You Need a Local 10007 Estate Planning Attorney The 10007 zip code is a unique and powerful corner of Manhattan, a place where historic

Why You Need a Local 10007 Estate Planning Attorney The 10007 zip code is a unique and powerful corner of Manhattan, a place where historic

The Significance of a Living Will in NYC: Your 2025 Roadmap As we progress through 2025, the necessity for advanced healthcare planning has never been

We all know that running our own business is something that we all want to do in our lifetime. Having our own successful business is

Child Custody Arrangements in New York: Understanding Types, Laws, and Considerations for Your Family Determining child custody arrangements is one of the most challenging and

WASHINGTON — Senate Majority Leader Chuck Schumer made a bold statement regarding the Israeli government’s actions during the conflict with Hamas, advocating for new leadership

Estate Planning Strategies Inspired by Jeff Bezos Jeff Bezos’ Estate Planning Vision Jeff Bezos, the billionaire founder of Amazon, has expressed his intent to donate

The 2024 Election and Its Influence on Estate Planning: A New York Outlook As seasoned professionals in estate planning, the team at Morgan Legal Group

Do you recall when you last looked into your estate planning? Your answer might be the point at which you marked the pile of documents

Smart Gifting: Reducing Estate Taxes and Supporting Beneficiaries in New York At Morgan Legal Group, our seasoned estate planning attorneys recognise the significance of employing

Navigating Life’s Transitions: Expert Legal Guidance in New York Life is a journey filled with significant milestones and transitions. At Morgan Legal Group, we understand

Managing and Distributing Real Estate within a Trust in New York: A Comprehensive Guide to Property Management, Beneficiary Distribution, and Legal Requirements Real estate is

Estate planning benefits all, whether one has a large estate or a small one. Formulating an estate plan makes sure that assets and property get

For removing the complexity of the probate process, proper planning is essential. It is the process of transferring the properties of the deceased to his/her

Strategizing Your 2025 Estate Plan with Charitable trusts As we approach 2025, Morgan Legal Group emphasizes the importance of a comprehensive estate plan that aligns

Planning for Long-Term Care Costs within a New York Estate Plan: Protecting Your Assets and Securing Your Future Care As New Yorkers live longer, healthier

An estate tax can be referred to as the charges on the estates for those whose value exceeds the limit that is set by the

An administrative proceeding refers to a legal process conducted by an administrative agency or governmental body to resolve disputes, enforce regulations, or make decisions related

Probate is a legal process used for administering an estate of a person who is deceased. This particular process takes care of all the distribution

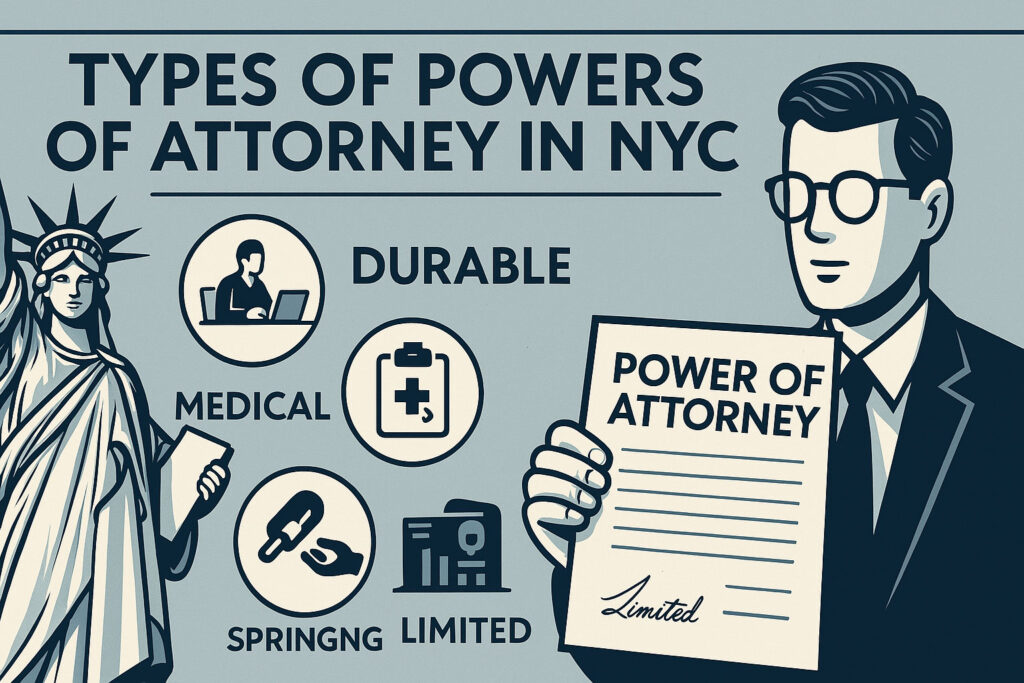

NYC Power of Attorney: A Complete Guide to Protecting Your Future In the bustling city of New York, planning for the unexpected is crucial. A

Season’s Greetings and Best Wishes for 2025! Celebrating the Achievements of 2024 As we close the chapter on 2024, Morgan Legal Group extends heartfelt gratitude

Utilizing Life Insurance in Estate Planning Amid 2025 Tax Changes: A New York Perspective As experienced estate planning attorneys at Morgan Legal Group, we understand

Nobody comprehends what the future will hold. Yet these essential estate planning tips will assist you with getting ready for anything. Life is loaded with

Many individuals often miss out on thinking about what will happen to their pets if they are no more. This is a very difficult subject

Understanding NYC Probate Process Probate is the legal process of settling and distributing assets and estates among beneficiaries. It involves validating a will in court

The Attack on American Democracy: President Biden’s Response In a recent address, President Biden reflected on the events of January 6th, when a violent mob

Seeking an Estate Planning and Probate Attorney in Brooklyn, New York: Expert Guidance for Securing Your Family’s Future Welcome to Morgan Legal Group P.C., your

Estate Planning in New York: A Comprehensive Guide Embarking on the journey of estate planning is a critical step towards securing your legacy and ensuring

Many people mistakenly believe that estate planning solely involves creating a will or trust to pass on assets. However, estate planning encompasses a wide range

How to Probate an Estate Quickly in New York 2025 Introduction: Simplifying Probate in New York Probate in New York can be time-consuming, often compounded

Understanding Wills and Trusts Legal Services: A Comprehensive Guide Effective estate planning is crucial for ensuring that your assets are managed and distributed according to

In a surprising turn of events, Mike Pence announced on Friday that he will not be endorsing former President Donald Trump for the 2024 presidential

Why You Need a Local 10027 Estate Planning Attorney Living in the 10027 zip code places you in one of New York City’s most vibrant